Trade War Revitalizes American Rare Earths

Tariffs on Chinese imports spark renewed investment in domestic mining and processing as demand for critical elements surges across defense and tech sectors.

A potentially positive byproduct of the Trump administration’s tariff and trade policies is the strengthening of U.S. rare earth mineral supply chains, making them domestically produced and less susceptible to foreign disruption.

As inflation ticks upward and markets respond to the latest round of tariffs and threats, Texas-based MP Materials is experiencing a resurgence. Domestic demand for its newly mined and recycled rare earth elements is increasing, driven by agreements with technology, automotive, and other digitally dependent manufacturers.

Rare earths—such as yttrium, cerium, terbium, thulium, and scandium—are essential components in the magnets used in everything from smartphones to stealth aircraft. They enable touchscreens and power seats, and windows in cars. Alongside semiconductors, rare earths are the unsung materials of the modern age. They’re not inherently scarce, but their extraction and refinement are complex and costly—hence the label “rare.”

The issue isn’t availability, but economics. The U.S. and other countries in the Western Hemisphere have viable rare earth deposits. However, extracting and refining these elements is expensive and environmentally taxing. Mining requires vast amounts of water, resulting in runoff that is challenging to manage and costly to remediate. When global prices are low, domestic production becomes economically unsustainable.

China, by contrast, controls approximately 90 percent of the global rare earths market, not because it mines the majority, but because it dominates the processing. Like crude oil, rare earths must be refined before they can be used. China’s cost advantage stems from lower labor costs and more lenient environmental regulations.

The United States once had a functioning domestic rare earths supply chain. The Mountain Pass mine in California’s San Bernardino County was a key source, supplying uranium and other elements for military applications during the Cold War. Over the past 30 years, the mine has cycled through periods of activity and dormancy due to rising costs and cheaper foreign competition.

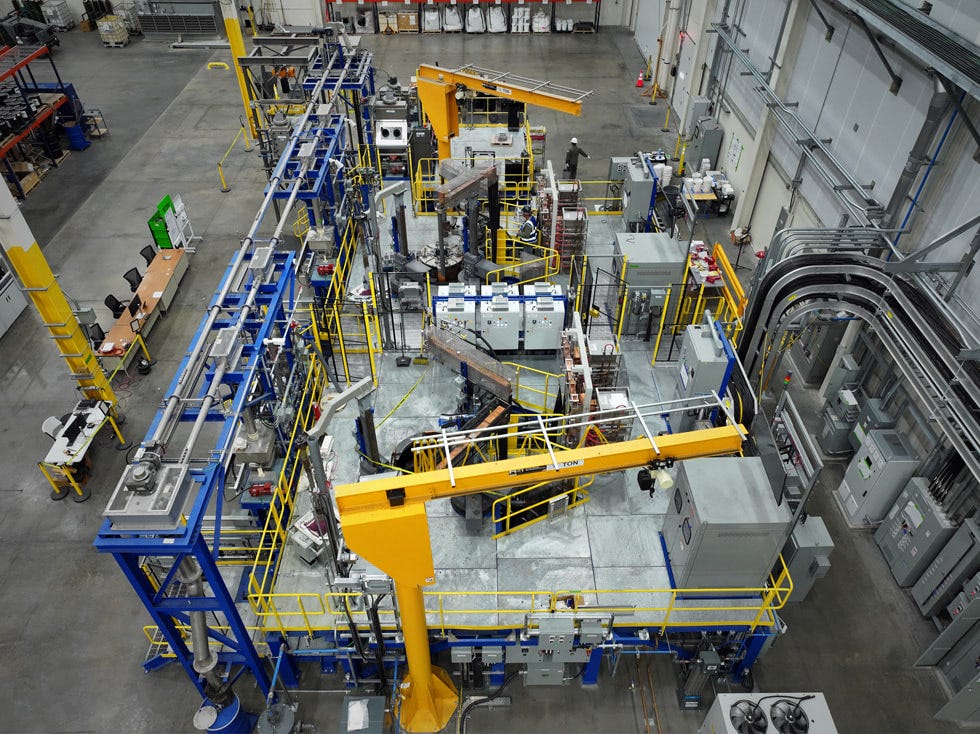

Now owned by MP Materials, Mountain Pass is once again experiencing a surge. The company recently signed a $500 million agreement to supply Apple with rare earths and is pursuing similar deals with General Motors and other manufacturers that rely on these elements. Demand is being driven by the need to mitigate rising input costs tied to tariffs and to diversify away from constrained supply chains, particularly those affected by Chinese export controls.

“American innovation drives everything we do at Apple, and we’re proud to deepen our investment in the U.S. economy,” said Apple CEO Tim Cook in a statement. “Rare earth materials are essential for making advanced technology, and this partnership will help strengthen the supply of these vital materials here in the United States. We couldn’t be more excited about the future of American manufacturing, and we will continue to invest in the ingenuity, creativity, and innovative spirit of the American people.”

The U.S. military is also investing heavily in MP Materials and other domestic sources of supply. Rare earths are critical to the development of advanced weapons platforms, including the F-35 stealth fighter, the B-21 Raider bomber, and a growing fleet of autonomous drones. The Pentagon was already facing supply chain pressure when China curtailed exports in response to U.S. tariffs.

The U.S. allowed its rare earths industry to erode under the assumption that mutual economic dependence would ensure long-term access to these resources. China needed the U.S. as much as the U.S. needed China, and war was considered bad for business. But as global tensions escalate—and as the war in Ukraine highlights the centrality of electronics in modern warfare—the U.S. is reevaluating its supply chain vulnerabilities.

Revitalizing the rare earths sector is one of the more defensible uses of tariffs. By making imported materials more expensive, tariffs can level the playing field for domestic producers. U.S. production collapsed not because of a lack of capability, but because it was too expensive compared to a steady and affordable supply from China.

One reason consumer electronics prices have not spiked is that most computer-related products were exempted from the Trump tariffs. Companies like Apple and Dell benefited from these exclusions but still built up inventory to avoid disruptions when future tariffs took effect. With tariffs now a persistent policy tool, many American tech companies are seeking domestic alternatives.

Tariffs alone, however, may not be enough. The Pentagon’s investments help anchor demand, but long-term viability may require government subsidies. The U.S. provides tax incentives and subsidies to oil producers; the same should apply to materials as strategically vital as rare earths.

For now, the resurgence in American rare earth production is a positive development. These materials are essential to daily life, economic competitiveness, and national defense. Keeping this supply chain outside of U.S. control is no longer a sustainable or acceptable risk.